Instead of scrambling for receipts or invoices, all of your financial information is organized on one central system. These issues might be preventing you from climbing the ladder to success! For example, let’s say that your business is losing money each month or that your overhead costs are too high.

Business

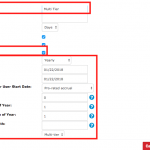

The service you decide to use depends on the needs of your business and may include extra features such as payroll or tax documents. Start by deciding on the system you want to use, whether it’s an online program, paid software or a spreadsheet. Next, set aside a dedicated time either weekly or biweekly to review your bookkeeping, reconcile transactions and complete necessary data entry.

Accounting is the interpretation and presentation of that financial data, including aspects such as tax returns, auditing and analyzing performance. Bookkeeping tasks provide the records necessary to understand a business’s finances as well as recognize any monetary issues that may need to be addressed. Proper planning and scheduling is key since staying on top of records on a weekly or monthly basis will provide a clear overview of an organization’s financial health. The single-entry bookkeeping method is often preferred for sole proprietors, small startups, and companies with unfussy or minimal transaction activity. Unlike accounting, bookkeeping zeroes in on the administrative side of a business’s financial past and present. Accounting, on the other hand, utilizes data from bookkeepers and is much more subjective.

Bookkeeping involves the recording, on a regular basis, of a company’s financial transactions. With proper bookkeeping, companies are able to track all information on its books to make key operating, investing, and financing decisions. Another type of accounting method is the accrual-based accounting method. This method records both invoices and bills even if they haven’t been paid yet. This is a highly recommended method how to use a touchscreen cash register six because it tells the company’s financial status based on known incoming and outgoing funds. Because the funds are accounted for in the bookkeeping, you use the data to determine growth.

- On top of that, you need the data used in bookkeeping to file your taxes accurately.

- If you’re organized and enjoy working with numbers, a job as a bookkeeper could be a good fit.

- Keeping your financial records organized makes it easier to locate and provide to appropriate parties.

You need to decide which accounting method you will use for your company. Either way, it’s critical to have an accurate balance sheet and income statements. Bookkeeping is the process of keeping track of a business’s financial transactions.

What is business accounting? 21 tips for business owners

Bookkeeping will give you the clear picture of what exactly works or doesn’t work. In order to make the best decisions possible, you need to have access to all available information. It should give you a great starting point for perfecting your bookkeeping strategy. Laura is a freelance writer specializing in small business, ecommerce and lifestyle content. As a small business owner, she is passionate about supporting other entrepreneurs and sharing information that will help them thrive.

Bookkeeping for Your Small Business

Bookkeeping is important because it shows your business’ profitability. For example, the income statement is one of the financial statements that is prepared from your bookkeeping. On the income statement, you audit evidence and audit testing can see if your business is profitable or not. Without this information, it is impossible to know how well (or not so well) you’re doing.

First, decide whether you will use single-entry or double-entry bookkeeping. Small businesses may start with single-entry, but as they grow, it’s advisable to switch to double-entry. Bookkeeping is a crucial function of accounting, and earning a bookkeeping certification is a great way to show employers your expertise. While a certificate is not a requirement to become a bookkeeper, some professionals pursue certification to show their skills to employers and stand major types of recording transactions out in their job search. A proper financial data management system can provide valuable, actionable insights and prevent problems, such as skimming fraud.

With an accurate record of all transactions, you can easily discover any discrepancies between financial statements and what’s been recorded. This will allow you to quickly catch any errors that could become an issue down the road. In short, bookkeeping is just one facet of doing business and keeping good financial records. Today’s technology offers various accounting software to simplify bookkeeping.

You can learn bookkeeping for free and at a low cost through online courses. These courses focus on bookkeeping fundamentals to help improve bookkeeping knowledge and skills. For example, you might complete the Intuit Bookkeeping Professional Certificate or several other bookkeeping courses offered by universities and companies on Coursera.